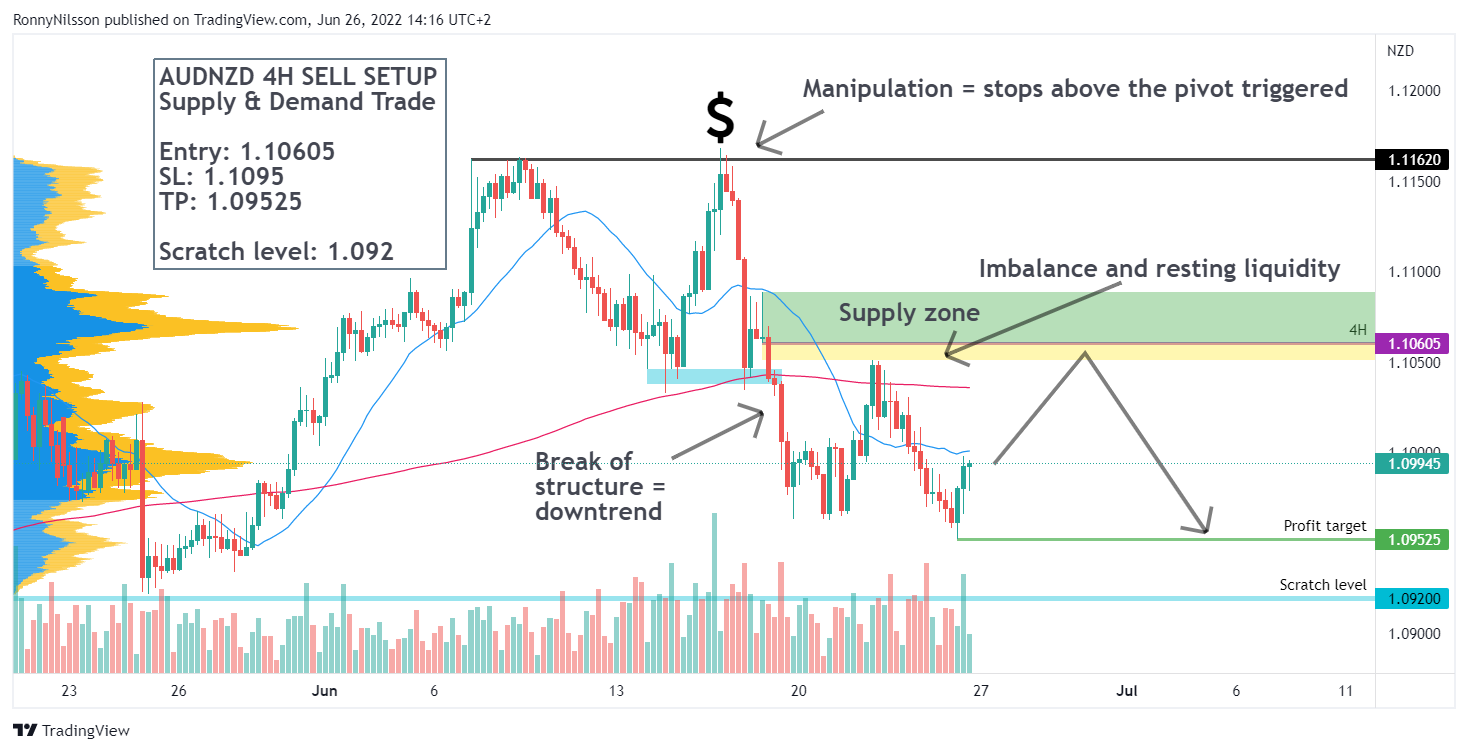

AUDNZD recently tested demand above the recent pivot high and failed. But in the process, stop orders in that zone were triggered, which qualifies as manipulation in my book.

We then got a strong drop, formed a short base and continued down breaking structure to confirm downtrend. The base is a nice supply zone in itself, where I expect resting orders to be placed and traders waiting to get in.

Last week we pulled back, but didn't quite reach the supply area. We also didn't fill the imbalance (yellow zone on chart) and the lower high here means liquidity is building above.

Lots of confluence here and logic dictates, that if we move up to fill the imbalance and tap into the lower high liquidity, the supply zone is a high probability are for price to reverse.

As a target, I'm simply looking at last week's low.

But I believe we can go further than that. 1.092 is a logical area looking at daily chart. Feel free to use it for TP2. This is also my scratch level. If we move here before getting a retracement to the supply zone, I'm discarding the trade.

Summary:

- AUDNZD 4H SELL SETUP

- Supply & Demand Trade

- Entry: 1.10605

- SL: 1.1095

- TP: 1.09525

- Scratch level: 1.092