Richard D. Wyckoff (1873-1934) is widely recognized as one of the pioneers of technical analysis alongside the likes of Charles Dow, Ralph N. Elliott and W.D.Gann. He was something of a compulsive student of the markets and the legendary traders of his time, like Jesse Livermore or JP Morgan. His framework has been conceptualized into the Wyckoff trading methodology, as it's commonly referred to today.

After observing and studying how the professional operators trade, he defined a set of principles, laws and trading methodologies. He did focus on the stock market, but his tool-set can be applied across markets. In addition, his approach is as applicable today as it was during his lifetime.

Below, I will aim to provide an introduction to the Wyckoff trading method. We will review the three fundamental laws and the four market cycles. In addition, I will explain trading schematics and also expand on what Wyckoff meant by the “Composite Operator”.

Wyckoff’s Composite Operator

The Composite Man or Composite Operator is a term quite frequent in Wyckoff’s published works and related literature. But who is this mystery man? Simply speaking, it’s the aggregate of the large institutions and professional traders and investors. In other words, the Composite Operator is the smart money active in the markets.

Wyckoff encourages us to view all market movements as the result of the Composite Man’s market operations. Our aim should be to trade alongside the smart money, not against it as most amateur traders do. And I will explain why this is the case later.

…all the fluctuations in the market and in all the various stocks should be studied as if they were the result of one man’s operations. Let us call him the Composite Man, who, in theory, sits behind the scenes and manipulates the stocks to your disadvantage if you do not understand the game as he plays it; and to your great profit if you do understand it.

Richard D. WyckofF

The Richard D. Wyckoff Course in Stock Market Science and Technique, section 9, p. 1-2

Composite Operator explained

So within the Wyckoff trading methodology, how does the Composite Operator manipulate the markets? And how can you identify their actions? This will all become clearer once you learn about the three fundamentals laws and market cycles, which we will explore below. But for the sake of clarity, let’s use one simple example.

Let’s say a certain stock is in a consolidation, meaning sideways price action. We correctly identify this as accumulation. Composite Man’s objective is to accumulate as much of this stock as possible before they start the markup phase.

He does this by short term manipulation of the prices, enticing the public to sell. The smart money might do this by correctly identifying a large amount of stop loss orders below the consolidation. As a next step, they induce short term selling pressure to tap into this zone of liquidity.

This in turn triggers the active stop loss orders but also sell stop orders placed under the zone by traders expecting a breakdown. The Composite Operator absorbs all these orders before stating the markup phase by inducing buying pressure.

If you have been trading for any longer period of time, I’m sure you have witnessed situations where your stop loss was triggered with a spike. And following this, price turned around and went straight in the intended direction. This was most likely the action of the Composite Operator. He saw a chance to effectively take on your position at a favorable price. In conclusion, he manipulated the market just enough to trigger yours and other traders stop losses. And then he pushed prices higher alongside other smart money.

Our competitive advantage

I guess at this stage the question arises, how can we compete with the Composite Man. We, meaning the relatively small operators, have one great advantage over the large institutions. It’s the fact that large institutions, by definition, trade substantial volumes. This leaves footprints in the markets and becomes very clear once we incorporate volume analysis into our trading.

Wyckoff kept emphasizing that as long as we understand market behaviors of the Composite Operator, we can identify trading opportunities early enough to profit from them.

The market cycle

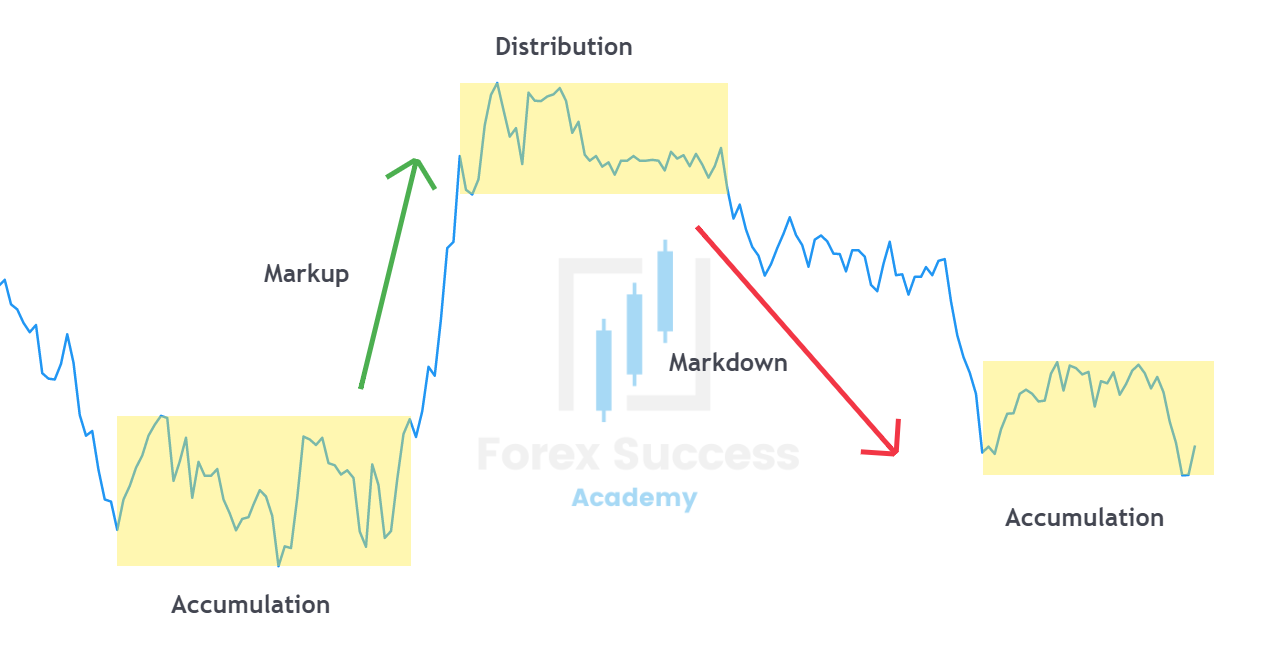

Wyckoff defined a market cycle consisting of four distinct phases. Correctly identifying the current phase, using price and volume analysis, is one of the keys to successfully applying the Wyckoff trading method. A full market cycle consists of accumulation, markup, distribution and markdown.

Accumulation is the phase where large operators do the bulk of their buying. In other words, we can explain this as an oversold area. Typically this phase takes the shape of a consolidation, where institutions are accumulating shares in anticipation of the markup.

Markup is the next phase, where demand is greater than supply and we see an uptrend with higher highs and higher lows.

Distribution, also referred to as the overbought area, is where institutions take their profits and the preceding trend comes to a halt.

Markdown is a downtrend with lower highs and lower lows, where supply overpowers demand.

In addition to these four main phases, there are also re-accumulations and re-distributions. The key difference between a re-accumulation and distribution is that the former resolves in a trend continuation and the latter in a trend reversal.

Market cycle analysis according to Wyckoff is a simple concept, but correctly identifying a current market phase is not easy. Mastering Wyckoff schematics will aid you in this skill and enable you to enter high probability trades when an accumulation phase is about to resolve into a markup phase. And vice versa with distribution phases and short trades.

Three fundamental laws of Wyckoff trading

The Wyckoff trading methodology defines three fundamental laws aiding you in your analysis. A thorough understanding of them will help you to identify assets ready for a move, project profit targets and identify correct price and time to enter your trade.

The law of supply & demand

Prices go up when demand is stronger than supply and vice versa. Simple fact, but actionable analysis of supply and demand dynamics will take some time to master. And correctly identifying supply and demand patterns will require some experience.

There are many traders who trade supply and demand concepts and patterns exclusively. It is a very rewarding concept if used correctly.

The law of cause and effect

This law helps you to determine price objectives for your take profit levels. A cause is the consolidation phase of an accumulation or distribution. The effect is the subsequent markup or markdown. Personally, Wyckoff utilized point and figure charts for measuring profit objectives. He used the horizontal point count of the trading range and then used the same distance projected vertically as the profit target.

Point and figure charts are not commonly used today. Many Wyckoff traders have simplified this rule by looking at the vertical measure of the accumulation or distribution phase and then projecting same distance from the breakout point in order to arrive at a profit target

The law of effort vs result

In essence, this law looks at divergences between price and volume action. If there is an effort (volume on a move), the result (price action) must be in proportion to that effort. When it’s not, this needs to be considered as a potential signal for an upcoming change of character.

This law also helps you to determine if a move out of a range is sustainable or likely to fail. You’ll be able to determine future direction by incorporating volume analysis in your trading. When prices break out of a range, the question you should ask is if there is sufficient demand in the market to sustain a prolonged move. And this can be simplified by looking at relative volume on your charts. Low volume accompanying a breakout should raise warning signals. Volume needs to enter the market to push prices in the desired direction and absence of it will often signal a false move.

Wyckoff trading schematics

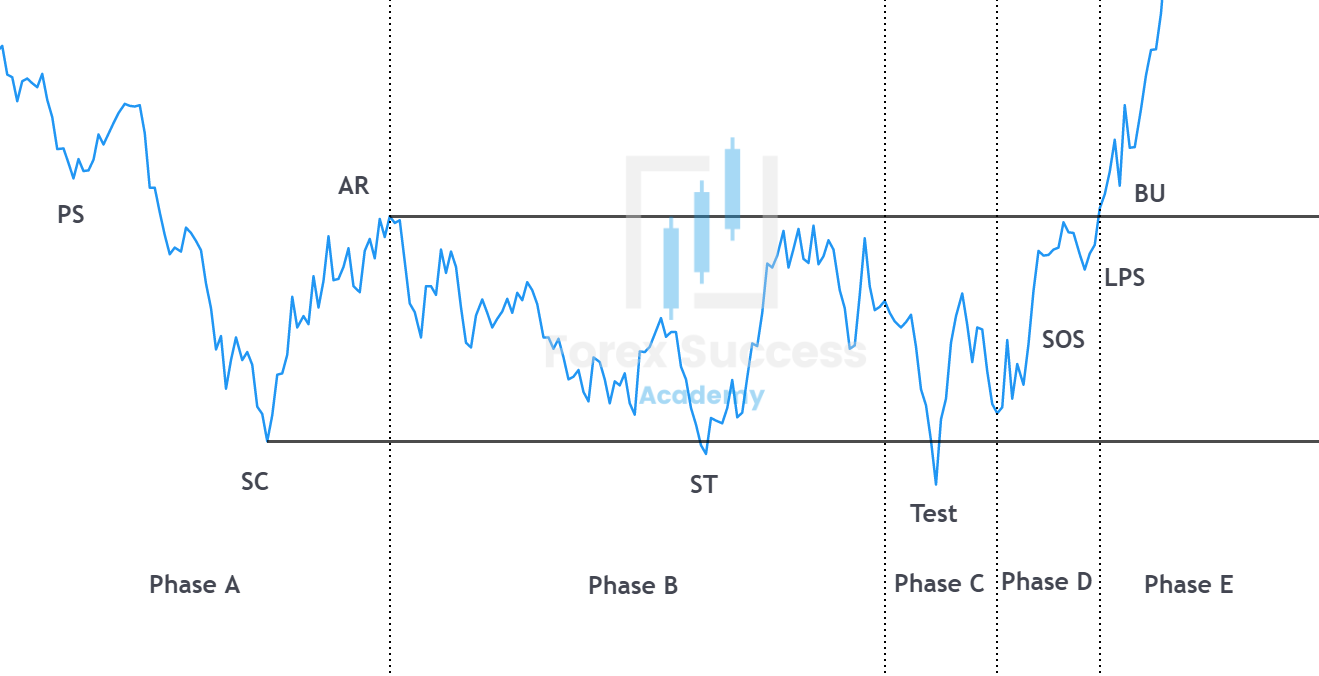

A Wyckoff schematic is a structure analysis of a distribution or accumulation phase. Full exploration is a topic for another post. My aim here is to provide a clear and simple to understand introduction to Wyckoff trading. So let’s take a look at a typical accumulation schematic.

There are five distinct phases to an accumulation schematic:

- 1Phase A: Stopping of the prior downtrend.

- 2Phase B: Building of the “cause”. This is where accumulation by large operators happens.

- 3Phase C: The test phase, where institutions test remaining supply and determine if the asset in question is ready for a move.

- 4Phase D: This is the uptrend within the range after a successful test.

- 5Phase E: Demand is stronger than supply and we move out of the range within an established uptrend.

Within the accumulation schematic, there are several distinct events Wyckoff traders pay attention to:

Wyckoff trading summary

Wyckoff trading is a comprehensive framework centered around the assumptions that market moves are to a large extent driven by large institutions. In other words, smart money. Correctly identifying the presence and actions of smart money enables us to trade alongside large institutions and presents us with high-probability trading opportunities. We're able to do this by utilizing volume analysis, Wyckoff schematics, supply & demand dynamics and structure.

The Wyckoff trading principles have stood the test of time. Many professional traders today use the Wyckoff principles in their trading. Including myself, as you'll see if you follow my trading analysis. That said, the approach is still not very widely followed within the retail trading community. This fact can give you a clear edge if you decide to learn and apply the Wyckoff method in your trading.

This is a very detailed explanation of what the Wyckoff trading framework is and the assumptions that market moves are centred around trading done by big institutions. I am very new to investing and are not currently involved in stock trading.

I have invested in ETFs, but there are certain stocks that I would like to invest in. Do you think that the Wyckoff trading principles can be used by a beginners? Or is there an easier set of trading principles that a beginner can use? Thank you.

Hi Line, thank you for your nice words!

Wyckoff principles might not be so beginner friendly to be completely honest with you. It will take a lot of chart time to get to a point where you spot the schematics and supply/demand dynamics without effort and will be able to take trades based on your analysis and observations. That said, don’t discard the method…read about it, try to look for accumulations and distributions on your charts and enter practice trades.

As a new trader, I would recommend you start with learning price action and then progress to market structure. I have put together a post on where to learn forex trading, including both paid and free resources. If interested, you can read it here 😉

Hi wow this is some really interesting stuff . I have always wondered on how forex trading and stocks really worked and just from this read you have given me some clarity. Being a newbie in trading what would you suggest as (a) A budget to get started and (b) where to start from and what platforms ,books and tools will be beneficial to me

Hi Daniel, thank you for commenting!

Regarding budget…the great thing about Forex is that you need very little capital to trade with. You can trade micro-lots with just a few hundred dollars in your account. For stocks, I would recommend at least $25k, especially if you’re planning on day trading.

Regarding where to start…I just published a post on where to learn forex trading. I listed some free and paid resources that are good quality and you can use the list as a starting point 😉

Hello Ronny,I read your article on the Wykoff trading principles with great interest. It was a good article to add to your portfolio because it can be applied to any trading activity, stocks, forex, and cryptocurrencies. Can it also be used to guide one in trading stock options? You explained the various phases of a chart really well. Since you talk about the relationship between the start of a trend and the underlying volume, I wish you had added volume bars underneath the graphs for illustration. I don’t think you based your lesson on actual charts so this could be difficult. But I feel it would have enhanced your discussion.In my blog, I have written seven articles on Forex. The one I feel was the most important was related to risk management. I think the Wyckoff principles could be used for this purpose too. A Forex guru named VP has created a series of videos on how to trade Forex. He made a huge point of learning how the Big Banks trade. In your article, you used the term Composite Man to identify the same entity. The way you explained it is also similar. Every day traders are fooled into making trades where they do not set their stop loss far enough away from being stopped out. So VP devoted a lot of time to how to set up one’s stop-loss so that this will not happen as often. Will you be writing a blog post showing how you set up your SL and TP levels? One day I want to create a blog myself devoted to Forex. I have even bought a domain name called theforexniche dot com I am not a successful forex trader like you are to trade professionally. When I do become successful, then I will develop this website too. I am going to bookmark your website and hope to learn from you. Thanks for creating it.Cheers.Edwin

Hi Edwin, thank you for your nice words!

The Wyckoff trading principles can be applied to any markets governed by supply & demand dynamics. So yes, can be applied to options as well 🙂

Nice to hear that you have written several Forex articles yourself. Feel free to post a link, I would love to take a look 🙂

A post on stop loss and take profit strategies and tactics is a good idea…thanks for the suggestion. I will add to my content calendar 😉

I wish you lots of trading success!

How did Richard change the ways of the stock market?

Was he any creator of a widely used strategy everyone uses nowadays?

I never heard of Richard D. Wyckoff before. It seems this guy was pretty rich because he knew the ways of the stock market and he created trading methodologies. He is insanely smart for that and also how he created strategies for the stock market.

The Composite Operator is a large institution and professional traders and investors. He wants to give the message out there about these people and what they do. Richard wanted everyone to work alongside smart money and not against as most of the amateurs do.

That is a cool strategy and something I would never even try to think of. Crazy how he manipulated the market and made the traders/amateurs lose money. He made it to work for the smart money and it when at a rise. He really hacked the system with his mind.

I learned a lot from the article about a person manipulating the market for the good for everyone and those who take it seriously. What a crazy time to live in while the stock market was still going after the 1930s (Great Depression Decade).

Hey Caleb, thank you for your comment!

Just to clarify, Wyckoff didn’t engage in market manipulation. He simply defined a set of rules and principles enabling small traders to trade alongside smart money, identifying and taking advantage of the manipulation happening in the markets by the large players.

He defined and started publishing his framework after extensive research and observation. I think his influence on the stock market and trading in general was significant and still is. His principles are used by many professionals today across various markets.

I learned about forex and how to trade about 3 years ago and it changed my life! Just learning the skillset of reading charts, using technical analysis, psychology, it was such an eye opener for me as a newbie. One of the first things I was taught was the 3 fundamental laws of Wyckoff. Every mentor I had mentioned his name so this all makes sense! You did a very well written post anyone could benefit from it!

Hi Lorenz, thank you so much for your nice words! That’s amazing that you have heard of Wyckoff and your mentors taught you the 3 laws. I wish you lots of success in your trading! 🙂

Although I knew about forex, I am not honestly aware of the Wyckoff Trading you mentioned in this post. But I think if we trade forex we must be aware of this. You have made it very clear in this post. I also use this Wyckoff method when trading forex. Thanks so much for this post.

Hey Pasindu, thank you for your comment! You’re far from the only one who has never heard of the Wyckoff method. Honestly I’m not really sure why it’s not utilized more. Might be the lack of available training teaching the Wyckoff concepts. It’s a really powerful trading framework and many professional traders I know of utilize it, including myself 🙂 I will aim to post more on this topic going forward…